Unreimbursed Employee Business Expenses 2024 Taxes

Unreimbursed Employee Business Expenses 2024 Taxes – Educators, including counselors and principals, can deduct up to $300 in unreimbursed expenses can include business expenses directly on their income tax returns on Line 12 of their Schedule . For the 2024 tax year, six states are making changes to the top marginal rate for corporate income tax. In all cases, corporations will be able to take advantage of a reduction in the rate. Scroll .

Unreimbursed Employee Business Expenses 2024 Taxes

Source : accountants.sva.comMark R. Stanhope CPA PC | Hudson MA

Source : m.facebook.comForm 2106: Employee Business Expenses: Definition and Who Can File

Source : www.investopedia.com🚗💨 IRS announces 2024 Standard Mileage Rates! 📈💼 | SIA Group

Source : www.linkedin.comExpired Tax Breaks: Deductible Unreimbursed Employee Expenses

Source : www.efile.comForm 2106: Employee Business Expenses: Definition and Who Can File

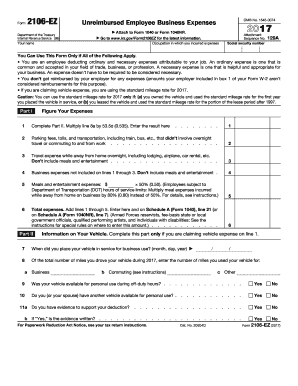

Source : www.investopedia.comIRS 2106 EZ 2017 2024 Fill out Tax Template Online

Source : www.uslegalforms.comElection 2024 Tax Plans: Details & Analysis | Tax Foundation

Source : taxfoundation.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comSIA Group Happy Veterans Day! Today we honor the men and women

Source : m.facebook.comUnreimbursed Employee Business Expenses 2024 Taxes Standard Business Mileage Rate Going up Slightly in 2024: Mule the merrier; cashing out; going for the gold; and other highlights of recent tax cases. Mule the merrier; cashing out; going for the gold; and other highlights of recent tax cases. . Question: I am going to have my tax returns prepared for the first time after and the method used for determining the fair market value. · A schedule of any unreimbursed employee business expenses .

]]>

:max_bytes(150000):strip_icc()/Screenshot2024-01-12at4.04.42PM-6ae67168a2a848849de8750450dab1af.png)

:max_bytes(150000):strip_icc()/28374128013_9b6d201c97_k-6dfa7d29e74146d79bf3bf71a3bd544a.jpg)